Trading strategies are essential instruments that can help an investor in traversing a jungle of financial markets. Whether you’re a beginner or an experienced trader, finding the best and probably easiest trading strategy can substantially influence your achievement. In this article, we will be touching on various strategies, talking about their principles and showing the way you can maximize your gains with the minimum efforts.

Table of Contents

ToggleMost Profitable and Easiest Trading Strategy

Trading strategies may include several methods that an investor can use when determining which assets to purchase and at what time to do so. These strategies are usually created on the basis of market data, risk aversion and investment objectives. Learning trading strategies basics can be considered as a crucial factor to help investors develop a profitable approach in the ever changing world of trading.

Fundamental Analysis

Fundamental analysis is a technique that looks at the intrinsic value of a given asset in order to assess factors such as economic indicators, financial statements, and market trends. By screening the elements such as income, revenue and macroeconomic events, traders can locate the undervalued or overvalued assets and make considered investment decisions.

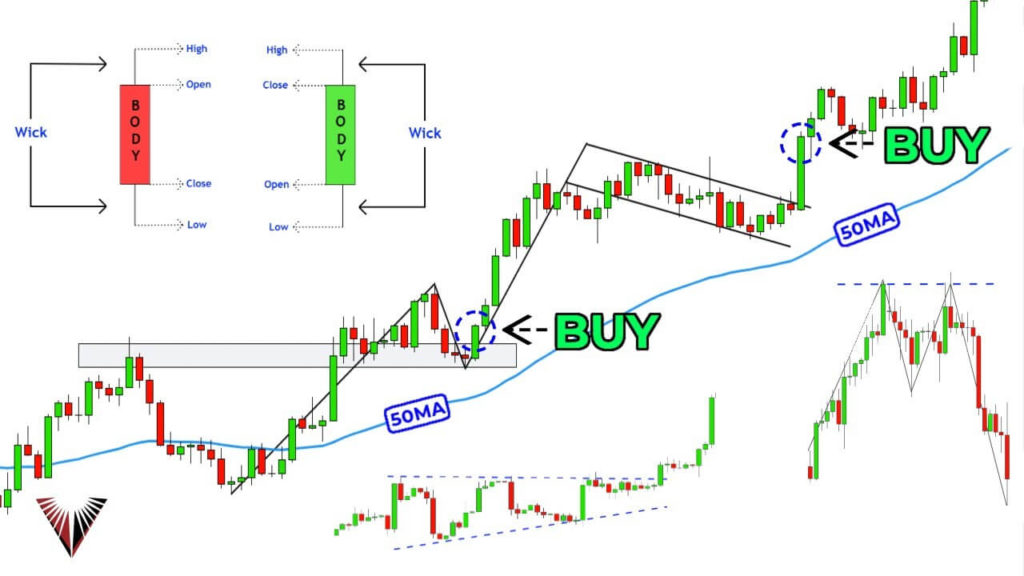

Technical Analysis

Technical analysis is data-oriented and makes projections based on historical price information and statistical indicators. Traders have a lot of tools, including charts, graphs, and patterns, to spot trends and patterns that may predict upcoming buying and selling events. The beginners of trading are going to use technical analysis to make a profit from market inefficiency by making use of the short-term price movements.

Swing Trading

Intraday trading is common among traders interested in profiting from short to medium-term price fluctuations. Traders seek out stocks or financial assets, which have price discrepancies for a short period of time, to capitalize on the subsequent price degree. Swing trading calls for patience, astringent and precise cognizance of market dynamics.

Day Trading

In day trading, traders execute multiple buy and sell orders in a single trading day intending to earn profit margins. Day traders pay close attention to the market volatility and depth of market to surface simple trading opportunities. This mechanism needs fast responses, analytical competence, and risk management extensively.

Trend Following

A trend following strategy is one in which you spot and take advantage of trending markets. Traders strive to hitch the train of the most recent price fluctuations by taking positions in the direction of the current trend. Trend following strategies can be very profitable during trend conditions, but will require a great deal of discipline and endurance in order to get through periods of consolidations or outright reversals.

Momentum Trading

Momentum trading is a type of trading and investing that aims to profit from the momentum or support of a price movement, in either the up or down direction. Traders seek assets that are showing signs of strength on the moving up or down and take positions that can take advantage of the continuation of momentum. Momentum trading entails timeliness, decisiveness and effective risk management as they are the top priorities.

Scalping

Scalping is a high-frequency trading strategy which targets small price movements that could lead to profits. Virtually seamlessly scalpers enter and exit positions quickly, they might perform hundreds of transactions in a day. This involves synchronizing trading on the spot market, short term trading infrastructure with high-performing computation, and claiming profits from small differences in the price.

Risk Management

Managing risks is critical for capital saving and maximizing the return on investment. Traders do so using different risk management techniques like limit price, diversification of their portfolios, and appropriate position sizing . Risk management is essential for traders for by doing so they give themselves a chance of not suffering devastating losses and achieving long term stability in the markets.

Psychological Factors

Psychology is an essential aspect of trading success. Forex trading involves human emotions like fear, greed, and overconfidence which can sometimes bring irrational decisions. Traders who successfully trade are mentally disciplined, keep their emotions at check, and execute their trading strategies exactly the way they plan. Traders, by learning the psychological factors, thus can bring focus, endurance and stability in their trading enterprises.

What is the most versatile and accessible trading method?

Now, let’s address the burning question: What is the most profitable and easiest business strategy to follow? It differs according to what an investor prefers, how much risk he or she is willing to accept and the particular conditions of the market. Nevertheless, strategy trend following which is characterized by its simplicity and effectiveness is another one that strongly impresses us.

Investors who trend follow look for clear patterns and set up their positions in the direction of the trend. This strategy benefits from the accumulation of momentum of price movement and lets the traders to be on the track that will bring them maximum profit. An advantage of trend following strategies is that they are very easy to implement and they spent less time and efforts on complex trading approaches.

This strategy enables traders to avoid the traps of attempting to adversely predict market bottoms or counter-trend movements. Contrary to that, they can simply get into the main spirit of the trend and make use of constant direction changes in price. Trend following strategies are lucid and not complicated at all, therefore they are fit for the novice and experienced traders.

Summarizing, the most profitable and easiest strategy on trading is trend following. Market trends recognition and corresponding trade execution can be one of the most effective trading strategies that require minimum effort and complexity and lead to the creation of consistent profits.

If you’re looking for more worthwhile investing-related topics like this, browse our website. For all that and more, subscribe to our newsletter to receive the latest updates directly in your inbox.