Tax season can be a stressful and confusing time for many individuals. With so many options available, it can be difficult to determine whether or not hiring a tax professional or using a software like TurboTax is the best option for filing taxes. In this article, we will explore the benefits and drawbacks of each option and provide guidance on which option may be best for you.

Before delving into the details, it is crucial for you to make an informed decision when it comes to selecting between CPA or Turbotax. It is highly advised that you read our informative article on Child Tax Credit to have a thorough grasp of this option. This article will provide you with useful information to assist you confidently traverse the decision-making process.

Table of Contents

ToggleTurbotax

First, let’s take a closer look at TurboTax. TurboTax is a tax preparation software that guides users through the tax filing process. The software is designed to be user-friendly and easy to navigate, even for those who have little to no experience with tax preparation. TurboTax is also affordable, with various versions available for different tax situations at different price points. Additionally, TurboTax has an accuracy guarantee, meaning that if there are any errors in the filing process that result in penalties or interest, TurboTax will reimburse the user for those costs.

Benefits of Turbotax

One of the biggest benefits of using TurboTax is the convenience factor. Users can file their taxes from the comfort of their own homes, without the need to schedule an appointment or leave their house. TurboTax also saves time by automatically importing data from previous tax returns and other financial accounts, reducing the amount of manual data entry required. The software also provides instant calculations and alerts users if there are any potential issues or mistakes in their return.

Drawbacks of Turbotax

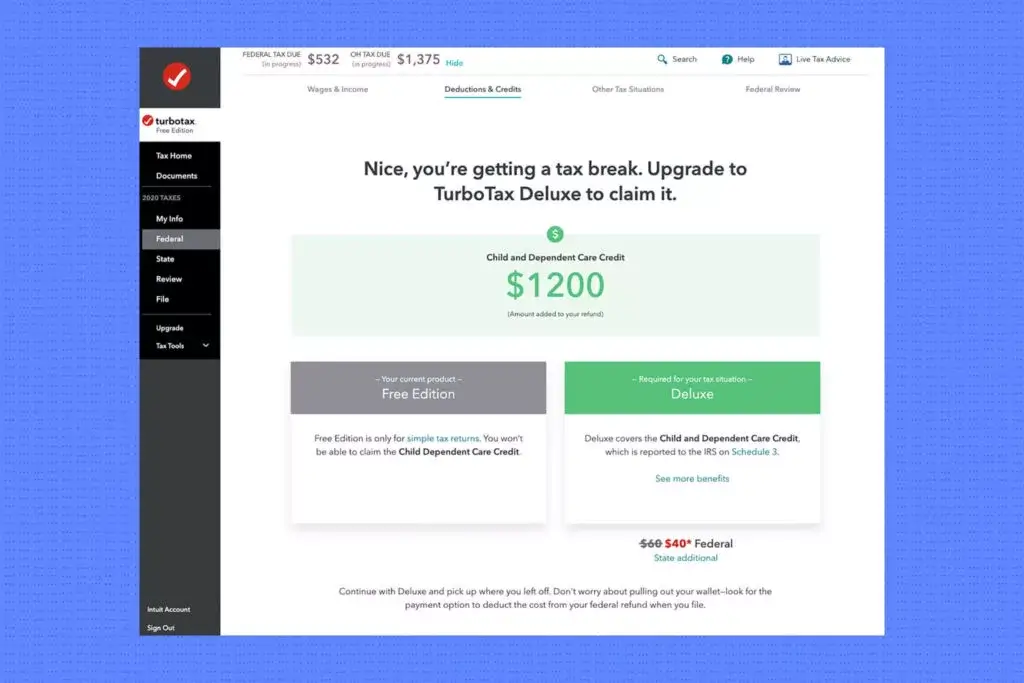

However, there are some drawbacks to using TurboTax. One potential issue is that the software may not be able to handle more complex tax situations. For example, if you have multiple sources of income or own a small business, you may need the assistance of a tax professional to ensure that all aspects of your tax return are properly addressed. Additionally, while TurboTax has an accuracy guarantee, this guarantee may not cover all potential costs associated with errors in your tax return.

Certified Public Accountant (CPA)

Now, let’s examine the benefits of hiring a tax professional. A tax professional, such as a certified public accountant (CPA), is trained to handle all types of tax situations, including complex scenarios. They have the knowledge and expertise to ensure that all aspects of your tax return are properly addressed and can help you navigate any potential issues that may arise during the filing process. Additionally, tax professionals can provide personalized advice and guidance, tailored to your specific financial situation.

Another advantage of hiring a tax professional is that they can potentially save you money. A tax professional can help you identify deductions and credits that you may not have been aware of, reducing your overall tax liability. Additionally, if you are self-employed or a small business owner, a tax professional can help you navigate the complexities of business taxes and ensure that you are taking advantage of all available deductions and credits.

Drawbacks of CPA

However, there are some drawbacks to hiring a tax professional as well. The biggest disadvantage is the cost. Hiring a tax professional can be expensive, with fees ranging from several hundred to several thousand dollars depending on the complexity of your tax situation. Additionally, scheduling an appointment with a tax professional can be time-consuming and may require taking time off work or rearranging your schedule.

CPA or Turbotax

So, which option is best for you? The answer depends on your individual tax situation and personal preferences. If you have a relatively simple tax situation, with only one or two sources of income and few deductions or credits, TurboTax may be the most cost-effective and convenient option. However, if you have a more complex tax situation, such as multiple sources of income, a small business, or investments, it may be best to consult with a tax professional to ensure that all aspects of your tax return are properly addressed and that you are taking advantage of all available deductions and credits.

If you do decide to hire a tax professional, it is important to do your research and find a reputable and experienced professional. Look for a certified public accountant (CPA) with a good reputation and atrack record of success. You can ask for recommendations from friends or family members or check online reviews to find a tax professional that suits your needs.

It’s also important to note that while TurboTax and other tax preparation software can be helpful, they are not a substitute for professional advice. If you have questions or concerns about your tax return, it’s always a good idea to consult with a tax professional. A tax professional can provide personalized advice and guidance based on your specific financial situation, helping you to maximize your tax savings and avoid any potential issues or penalties.

In conclusion, whether or not you need a tax professional or can use TurboTax depends on your individual tax situation and personal preferences. TurboTax can be a convenient and cost-effective option for those with simple tax situations, while a tax professional may be necessary for those with more complex tax situations. Ultimately, the most important thing is to ensure that your tax return is accurate and complete, and that you are taking advantage of all available deductions and credits. Whether you choose to use TurboTax or hire a tax professional, it’s important to take the time to understand your tax situation and make informed decisions about your filing options.